Mint, YNAB, Personal Capital, and Lunch Money: A Comparison of Personal Finance Tools

For years, Mint was the first thing people would recommend to anyone looking for a budgeting or personal finance tool. More recently, competitors like You Need A Budget (YNAB), Personal Capital, and Lunch Money have grown in popularity. Over the last couple years, I’ve spent some time using all of these apps because I wanted to explore the alternatives to Mint. Let’s explore the similarities and differences to see what might work best for you.

Mint

I used Mint for a long time, starting around 2013. Mint was the original online budgeting and personal finance tool (or at least the first one to become popular), and it developed a large following. In large part, I think its popularity was due to the fact that it could automatically pull credit card transactions and keep them up to date. In the early days of personal finance tools, that was revolutionary. It was a huge improvement over what most people had been doing before, which might have involved some kind of manually-updated spreadsheet or physical envelopes.

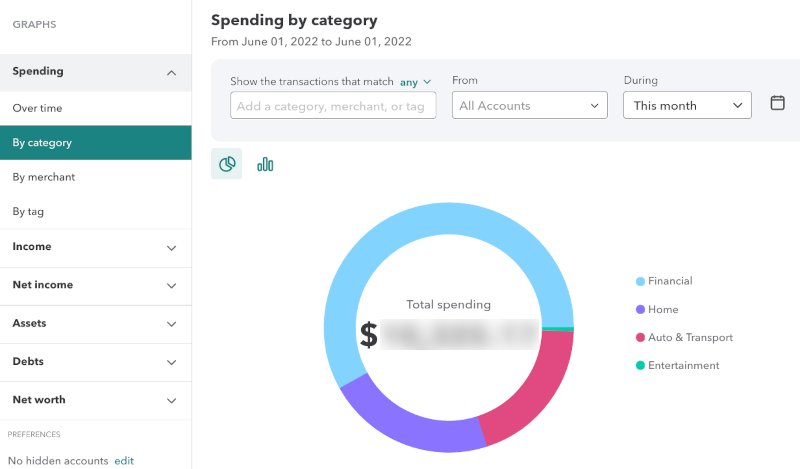

Mint’s core feature is the ability to aggregate transactions from different financial institutions and categorize them into a budget. You can configure Mint to automatically assign categories based on the merchant name, and you can use these categories to create a monthly budget. Mint will show you how your spending compares to your budget for all the categories in the current month. Aside from budgeting features, Mint also has some basic reporting features (graphs). You can break down your spending, income, assets, and debts in a few different ways like by category or over time. Mint can also track your net worth, though the graph is rather simplistic, showing assets and debts but with no further breakdown.

Aside from the features mentioned above, Mint also has some “tools” for finding credit cards or loans, doing your taxes, buying stocks, or viewing your credit score. I put “tools” in quotes here because in my opinion, these are basically just ads for services offered by Intuit or someone advertising with them. One of the reasons Mint is available for free is because it contains these ads. If you sign up for a credit card or loan through Mint, Mint will probably get some revenue for advertising it.

Today, Mint is more than 15 years old and is actually still very good at all the things it was originally good at. Although it’s changed a little over the years, it’s remained largely the same. Some people might like the fact that it doesn’t change too much, but it’s also one of the things some people complain about. Intuit, after purchasing Mint in 2009, seems not to have invested much in adding new functionality to the app (aside from ads and connections to other Intuit products). Lots of people wish Mint was owned by a company that appeared to care more about improving it. Instead, it’s owned by Intuit – a company that many people hate because they lobby to make tax laws more complicated (and probably use profits from Mint users to do so). (In case you don’t know how Intuit lobbies to make your life more difficult, you can read about it here.)

Who should use Mint?

Mint might be best for you if you don’t want to pay for a personal finance app or if you’re just getting started with personal finance apps and want simple, basic features. It’s easy to use Mint to categorize transactions from different banks, assign them to categories, build a budget, and view simple reports. But in exchange for the free service, you’re basically giving away your financial data, so Mint might not be the right choice if you’re privacy-minded. Also, Mint lacks advanced features, so you might want to consider other apps if you want things like advanced categorization rules, zero based budgeting, or more detailed reports.

Personal Capital

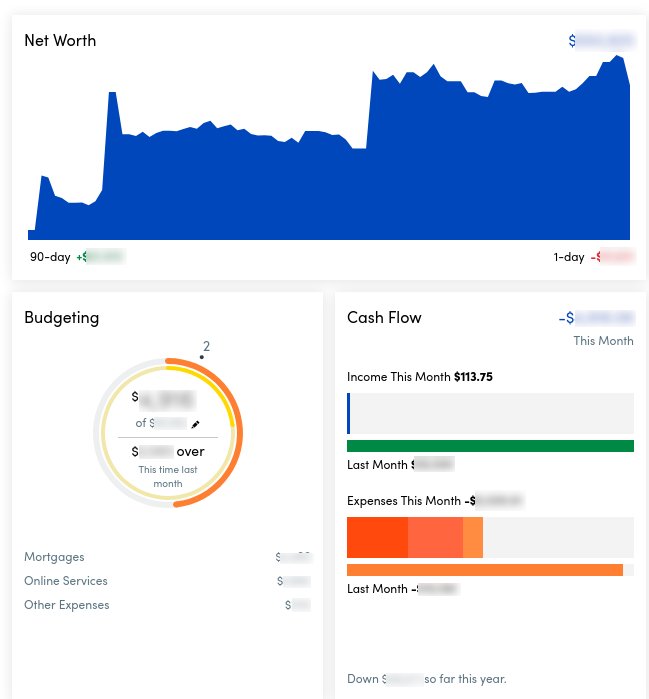

I started using Personal Capital after reading the recommendation on the Mad Fientist blog. Like him, I wanted to get a better picture of my personal financial portfolio to watch my net worth grow over time and to track the performance of my investments in a single place. Personal Capital is a great tool for this! While Mint is focused primarily on transactions and budgeting, Personal Capital is focused primarily on investments and net worth.

Features for tracking investments and net worth make Personal Capital stand out from other tools. For example, you can break down your net worth over time by investment type or account to see how it’s affected by your investments, loans, cash, and other assets. Personal Capital also has useful features for stock investors. You can compare your performance to different indexes. You can view your asset class allocation across all your accounts to get a better understanding of your total portfolio. And you can use a fee analyzer to see how much your investments might be losing to fees.

Personal Capital offers some pretty great investment tracking features, and you might be wondering how they can offer the product for free… In some ways, their business model is similar to Mint, though they seem a little more restrained in their use of ads. Primarily, you’ll see unobtrusive ads that offer you the services of a financial advisor. But there’s little doubt that they’re using your data to understand what kind of value you might bring as a client.

Who should use Personal Capital?

I’d recommend Personal Capital to someone who wants to track the performance of their investments and net worth in a single place. And it doesn’t have to be the only service you use! Mint and Personal Capital work quite well together since they’re both free. Mint is better for budgeting while Personal Capital has more features for investments. But I’d also note that because Personal Capital’s a free service, you should assume they’re going to use your data (e.g. for ads) – even if their ads are primarily for their own investment products and advisors. Like Mint, Personal Capital might not be the right choice for you if you’re privacy concious.

You Need A Budget (YNAB)

A couple years ago, I began to care a little more about privacy. I realized that most of the time, when companies give something away for free, it’s because they want my time, money, and attention, and they want to use my data to target me with advertising. (And if the company is Intuit, they’re probably using profits from my data to make my taxes more complicated.) From that perspective, I’d prefer to pay a small fee for access to a product or service rather than getting it for free. If I’m paying to use the product, the developers should be incentivized to make the product best for me rather than to make the product best for advertisers. So I became more interested in personal finance apps that require a subscription, and I found that YNAB was one of the most frequently recommended.

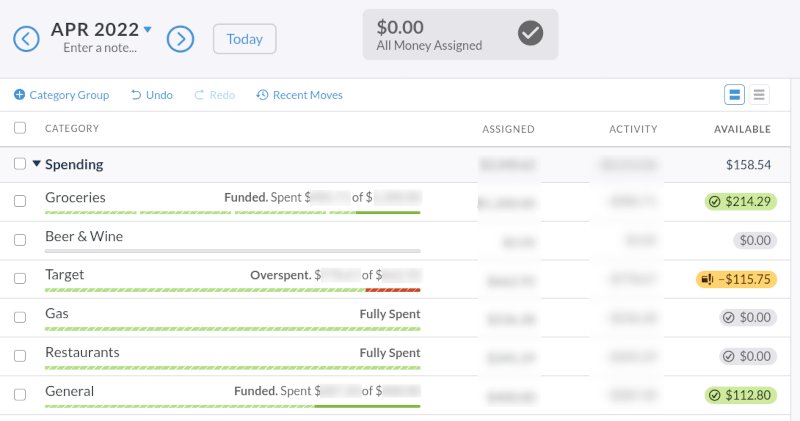

People love YNAB. It has an almost cult-like following. So I was excited to try it and see what all the hype was about. I started a free trial, but the software seemed a little confusing and tedious. YNAB takes a highly opinionated view of budgeting that follows a couple rules, as outlined in their intro videos:

- Give every dollar a job

- Embrace your true expenses

- Roll with the punches

- Age your money

They call this concept zero based budgeting. Essentially, that means you don’t allocate dollars until you have them in your account, and you allocate every dollar you have in your account.

I understand why that approach makes sense, but it wasn’t for me. After giving up on my first trial, I thought maybe I just needed to give YNAB more time, so I bought a subscription and tried it for several more months. I still didn’t like it much. I think part of the reason is that I didn’t really want to budget. At least, not in the serious way YNAB requires. I primarily wanted to see where my spending was going so I could think about whether I was saving enough and where I might be spending too much. I was able to get that information from YNAB, but I was also spending a lot of time allocating my money to different budget categories (giving every dollar a job), and it felt unnecessary and tedious because I wasn’t changing my behavior or budget based on that info. I was making up my budget as I went. YNAB budgeting would have been a great way to rein in overspending, but I didn’t have an overspending problem, so it just felt toilsome.

Who should use YNAB?

I do think that YNAB is a really great tool for someone who is serious about budgeting. If you need to get your spending under control, I think YNAB will probably help you do that better than any other budgeting tool available, and I think the thousands of happy YNAB users you can find online are a testament to this. On the other hand, if you’re like me and you want to track your expenses without spending a lot of time learning and applying YNAB’s budgeting approach, it might not be the best tool for you.

Lunch Money

Lunch Money is a pretty new personal finance tool. I first found out about it from a friend (who’s also a software developer). It’s a great startup story – it was created by a solopreneur to solve her own personal finance needs, and it won the Jamstack Conf Web App of the Year award in 2020.

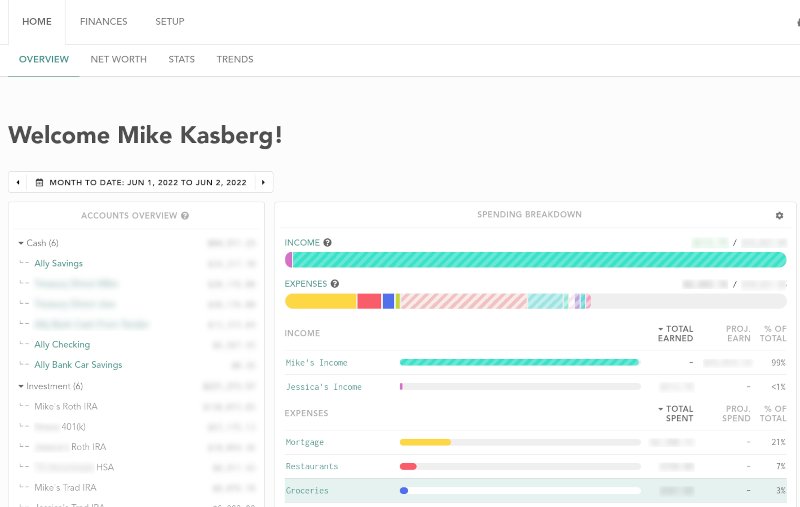

Like YNAB, I also tried Lunch Money twice. The first time I tried it, I started a free trial and decided after a couple days that it felt like a glorified spreadsheet and wasn’t really what I wanted. But when I gave Lunch Money a longer try, I became increasingly impressed with it as I discovered more features. I realized Lunch Money was exactly what I was looking for, and was more powerful than any spreadsheet I would ever build. It does a great job finding and matching recurring transactions, which is a pretty cool and unique feature. It also allows you to build more advanced rules than most other services, and I appreciate that I can do things like categorize a transaction based on the account it belongs to. As I spent more time with Lunch Money and got more data into the system, I kept finding more useful features. I think it does a decent job tracking net worth (though doesn’t track stocks in the same detail as Personal Capital), and I like the stats and trends it exposes. I find the “Overview” to be a really good high-level representation of this month’s spending, and I really like that it shows recurring transactions that are expected but haven’t happened yet.

I think a big reason why Lunch Money does such a great job is because it was built by a single person who must have been frustrated with existing tools and knew exactly what she wanted to build. Lunch Money still feels a little bit like a startup product, but I actually like that a lot. Sometimes you run into something that’s not quite perfect, but you can also tell that the product is being worked on and improved. And I like that by supporting Lunch Money, I’m supporting a solopreneur and an independent product that isn’t controlled by a large corporation.

Who should use Lunch Money?

Lunch Money provides budgeting tools that are on-par with or better than Mint, and also provides good net worth tools and reports. Perhaps most importantly, it has unique features like detecting recurring transactions and showing them on the monthly overview. I think that Lunch Money is the best tool to gain a deeper understanding of your own personal finances. Lunch Money isn’t free, but I actually think that’s a good thing. Because it requires a subscription, you’re the customer and it’s focused on providing value to you rather than profiting off your data. If you want a strict budget to get your spending under control, YNAB might be better for you. But if you want a more flexible budget or just want the best tool to track your spending, Lunch Money is the way to go!

Tl;dr

I’m currently using Lunch Money to analyze my own personal finances, and it’s the first product I’d recommend to others since I had such a great experience with it. But if you feel like your budget’s out of control and you really need to rein in your spending, YNAB might be better for you. Finally, Mint and/or Personal Capital might be good if you want a free tool, but beware that if you’re not paying for the product, there’s a good chance the product is more focused on providing value to companies and advertisers than providing value to you.

I wasn’t compensated to write this article, and the views and opinions expressed above are my own. As I’ve said before on this blog, I just enjoy writing about great software. For this particular article, however, I am using referral links for Lunch Money above. Lunch Money is great software that I actually use myself, and the referral links help offset some of the cost of running this blog!

About the Author

👋 Hi, I'm Mike! I'm a husband, I'm a father, and I'm a senior software engineer at Strava. I use Ubuntu Linux daily at work and at home. And I enjoy writing about Linux, open source, programming, 3D printing, tech, and other random topics.

I run this blog in my spare time, without any ads. There's no need to pay to access any of the content on this site, but if you find my content useful and would like to show your support, this is a small gesture to let me know what you like and encourage me to write more great content!

Related Posts

- Monitoring Gross Income with Lunch Money 19 Sep 2022

- Make a Useful Budget in Mint 06 Jul 2014

- KeePass vs Bitwarden: A Comparison of Free Password Managers 20 Nov 2018